Netflix has reported a strong performance in the second quarter of 2024, adding over 8 million new subscribers and surpassing analyst forecasts. However, the streaming giant tempered this success with cautious guidance regarding its advertising business, which it anticipates will take until 2026 to become a significant revenue contributor.

The surge in subscribers can be attributed to Netflix’s crackdown on password sharing and the popularity of hit shows such as “Bridgerton,” “Baby Reindeer,” and “The Roast of Tom Brady.” Despite this growth, the company warned that subscriber increases may slow in the third quarter compared to the same period last year.

Netflix’s advertising business, launched in 2023, has yet to establish itself as a major revenue source. The departure of Peter Naylor, the company’s vice president of ad sales, has raised concerns among analysts, who emphasize the need for Netflix to scale its advertising efforts to compete effectively with Amazon, which has made significant strides in the ad market.

“Netflix remains the leading and most profitable streaming service, but some investors may choose to cash in on the good news and wait for a better opportunity to re-enter the stock,” said Michael Ashley Schulman, chief investment officer at Running Point Capital.

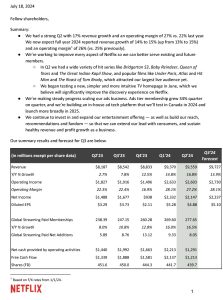

The company reported diluted earnings of $4.88 per share for the quarter, exceeding the consensus estimate of $4.74. Revenue reached $9.56 billion, in line with expectations. Although Netflix shares initially dipped, they rebounded to show a 1% increase in after-hours trading, reflecting a nearly 30% rise in stock value this year.