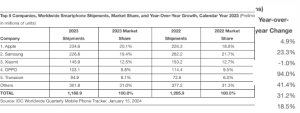

In a significant development, Apple has outpaced Samsung in global smartphone shipments, marking the first instance of Apple securing the top spot in over a decade, according to reports from IDC’s Worldwide Quarterly Mobile Phone Tracker. Although IDC acknowledges that its data is preliminary and subject to change, another research agency, Canalys, also confirms Apple’s dominance throughout 2023. IDC reports Apple’s total mobile shipments at 234.6 million, surpassing Samsung’s 226.6 million. Xiaomi, Oppo, and Transsion complete the top five, shipping 145.9 million, 103.1 million, and 94.9 million smartphones, respectively.

This reversal in rankings is noteworthy, as IDC highlights that the last time Samsung did not lead the annual board was 13 years ago in 2010. At that time, Nokia claimed the top spot, followed by Samsung, LG Electronics, ZTE, and Research in Motion (manufacturers of BlackBerry devices) in the top five. This historical perspective underscores the transformative changes in the smartphone industry over the past 13 years.

IDC’s Worldwide Tracker team research director, Nabila Popal, notes, “Not only is Apple the only player in the Top 3 to show positive growth annually, but also bags the number 1 spot annually for the first time ever.” Popal attributes Apple’s ongoing success to the increasing trend of premium devices, constituting over 20% of the market, driven by aggressive trade-in offers and interest-free financing plans.

While Apple played a pivotal role in displacing Samsung from the top spot, it faced fierce competition from other Android manufacturers like Huawei, OnePlus, Honor, and Google. Canalys suggests that Huawei’s “improving strength” could pose a challenge to Apple’s growth in the Chinese market. Reports from the previous year indicated that Huawei overcame US sanctions, integrating an advanced 7nm processor from Chinese chipmaker Semiconductor Manufacturing International Corp. (SMIC) into its Mate 60 Pro smartphone, capable of 5G speeds.

Although overall smartphone shipments declined by 3.2 percent in 2023 compared to 2022, there are signs of a potential market recovery. IDC reports an 8.5 percent year-on-year growth in shipments in the fourth quarter, while Canalys indicates an 8 percent growth after seven consecutive quarters of declines.