Warner Bros. Discovery reported an $86 million profit for its Direct-to-Consumer (DTC) unit in the first quarter, propelled by the success of its streaming and premium pay-TV services. The company’s global streaming subscribers reached 99.6 million by the end of March exceeding Wall Street’s expectations, yet its studios encounter a 70 percent profit decline.

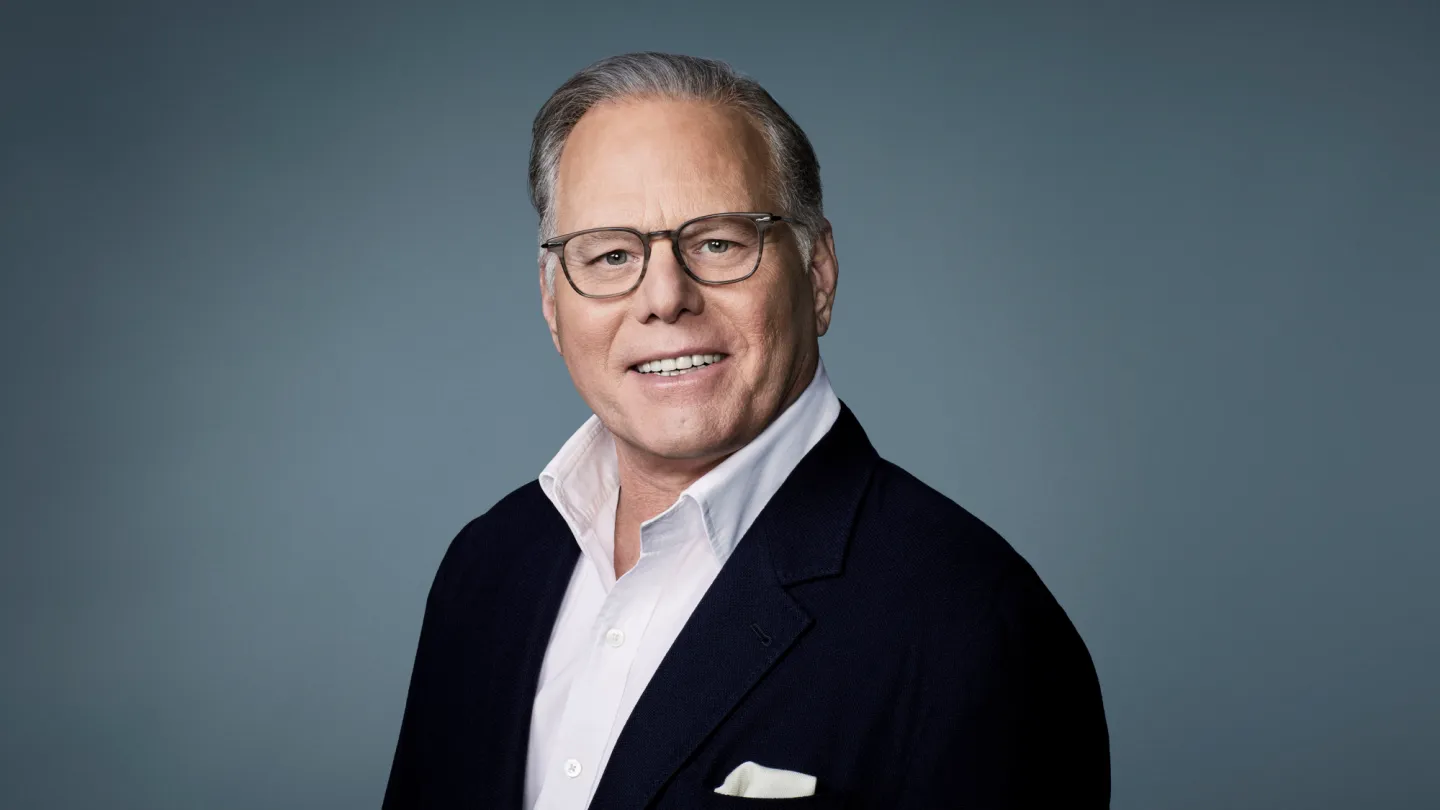

CEO David Zaslav emphasized the future of the studio and the streaming landscape, highlighting the importance of packaging and marketing streaming products together. He discussed proposed bundle partnerships with rival studios, aiming to enhance profitability in the face of competition from industry leaders like Netflix and Amazon Prime Video.

Zaslav outlined plans for a triple-play bundle of Disney+, Hulu, and Max, emphasizing its attractive pricing and consumer experience. The company also aims to retain NBA media rights and explore opportunities in the event of a studio breakup.

Despite these strides in streaming, Warner Bros. Discovery’s studios segment faced challenges in the first quarter, with revenue and EBITDA dropping significantly due to the fallout from Hollywood strikes and weaker gaming results. The company’s networks unit also experienced revenue and EBITDA declines, driven by weaknesses in the linear business and advertising revenue.

As the industry continues to evolve, Zaslav anticipates more collaborations between Max and linear TV channels, leveraging the success of content like ID’s “Quiet on Set: The Dark Side of Kids TV.” Despite these efforts, the company reported a 7 percent decrease in total revenue and a quarterly loss of $966 million, attributed in part to acquisition-related expenses.

Although the first quarter reveals weaknesses in the studios and networks segments, Warner Bros. Discovery is committed to strategic initiatives to navigate the evolving media landscape. Despite declines in total revenue and profitability metrics, the company is addressing challenges and capitalizing on growth opportunities.